-

- /

- Savings

- /

- Savings Fixed Rate

Earn up to 4.20% AER* for 1 year

Other competitive rates available for 2 and 5 years fixed.

-

Watch your money grow without interruption with a Fixed Term Savings Account from Afin Bank.

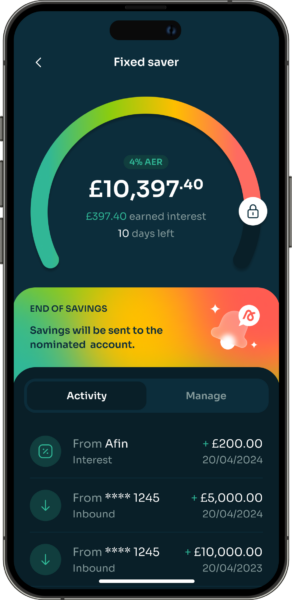

Whether you’re looking to save for one year or two, along with a fixed rate, Afin may have what you’re looking for. What’s more, with an app that lets you see how much interest you have earned whenever and wherever you want, it will help you keep track of your goals.

Ready to set up a Fixed Term Savings Account with us? We’re here to help.

Which Fixed Term

Savings Account

works best for you?

Our Fixed Term Savings Accounts are similar in all ways other than the time your money will be locked away. To make your decision simple, consult the below table.

*AER, or Annual Equivalent Rate, shows what the interest rate would be if interest was paid and compounded once each year.

Summary

box

This document is part of the Fixed Term Deposits Specific Terms and Conditions. Read it alongside the Deposits General Terms and Conditions. The information here highlights the main features of the account but doesn’t replace reading the full terms.

1-Year Fixed Term Account (Issue 4)

Balance: £1,000 – £200,000

Gross Annual Interest: 4.20%

AER*: 4.20%

- Interest is calculated daily and paid annually.

- You can choose to have interest paid into your Savings Account or

Nominated Bank Account.

No, the interest rate is fixed and will not change during the fixed term.

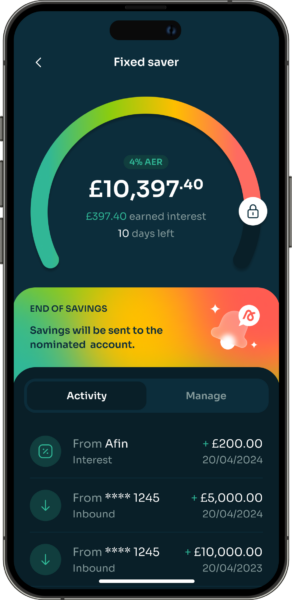

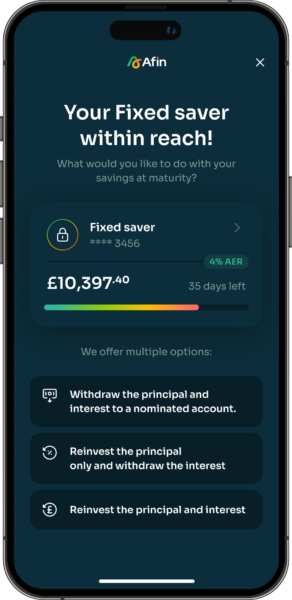

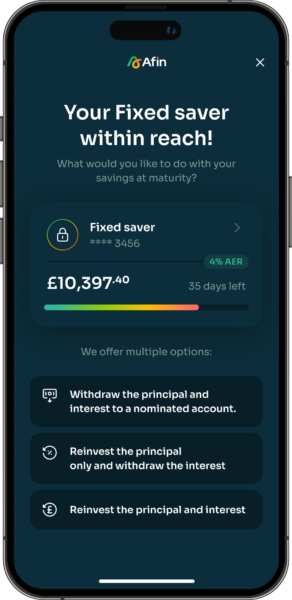

At the end of the fixed term, if you do not provide us with instructions to open a new account for you, we will return your funds, and the interest earned, to your Nominated Bank Account. We will notify you before the end of the fixed term to let you know what your options are. If we are unable to send the funds to your nominated account we will hold your funds in an interest bearing easy access account until we receive instructions from you.

This projection is just an example and does not consider your personal circumstances.

It assumes that:

- Interest is paid into the account.

- No further deposits or withdrawals are made.

- The period does not include a leap year.

Deposit at account opening: £1,000

Interest earned at the end of the term: £42

Balance at the end of the term with interest (12-months): £1,042.00

To open this account, you must:

- Be 18 years or over.

- The account can only be used for individuals.

- Be a UK resident (for tax purposes).

- Have a valid mobile phone number.

- Have a valid email address.

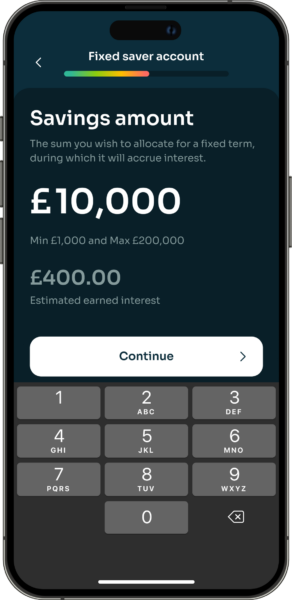

Opening an account:

- You can apply for an account via our mobile app which can be found here.

- You will need your contact details, email address and details of your UK current account you wish to register as your Nominated Bank Account.

- If we need additional information about your application, we will contact you.

Managing your account:

- You can manage your account via our app.

- You can also contact us by telephone to provide instructions about your

account.

Minimum / Maximum balance:

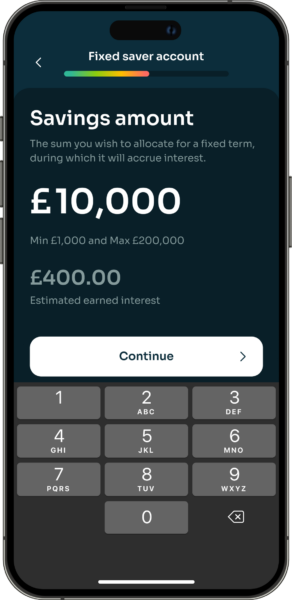

- Minimum balance – £1,000.

- The maximum balance is £200,000 per account holder. If you deposit more than this, the extra amount will be returned to your nominated bank account. This limit applies to the total balance across all your Afin Bank deposit accounts.

- Your eligible deposits with Afin Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered.

- You cannot make withdrawals during the fixed term. We will write to you before the end of your fixed term to give you information on what to do next.

- In exceptional cases, we may allow a withdrawal at our discretion. You will need to provide evidence, but we are not required to approve it. If we do approve the withdrawal, we will return the funds, and any interest earned to your nominated bank account.

- An account may only be held in single names.

- If you do not meet the minimum balance within 14 days of opening your account, we will cancel your account without penalty or notice and return your funds to your Nominated Bank Account.

- You cannot access the funds in your account before the end of the term once the funds meet the minimum balance requirements, your account will be activated from that date.

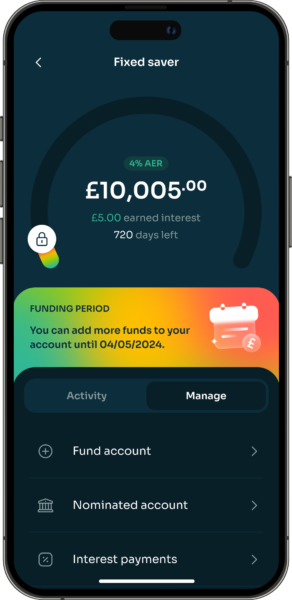

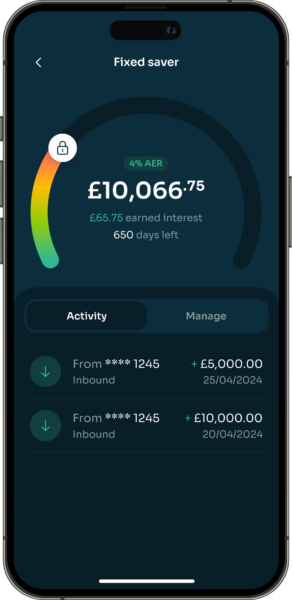

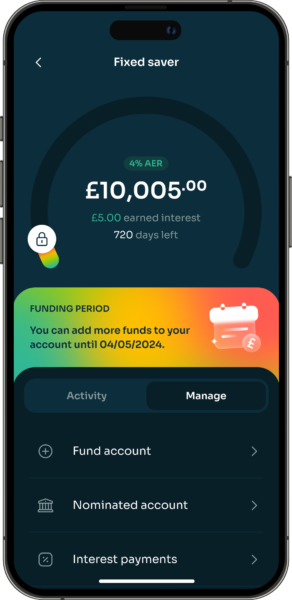

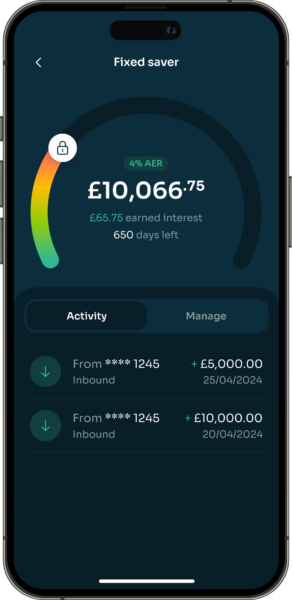

- You can fund your account multiple times within the deposit window (first 14 days from account opening), subject to the deposit limits. If you wish to change your Nominated Bank Account, you can do so in the app.

Your Nominated Bank Account:

- Your Nominated Bank Account is where we will send your money based on your maturity instructions.

- Your Nominated Bank Account must be a UK current account in your name.

Interest rate definitions:

- AER stands for Annual Equivalent Rate. It shows what the interest rate would be if interest were paid and compounded once each year.

- Interest is only compounded if you choose to pay the annual interest earnings into this account and not your Nominated Bank Account.

- Gross p.a. is the interest rate without tax deducted.

Tax:

- Interest is paid gross, without the deduction of income tax. It is your responsibility to ensure that any tax is paid. The interest earned on this account becomes taxable in the tax year the bond matures.

- We reserve the right to make a deduction for withholding tax as may be required by law from time to time.

- The tax treatment of the interest payable depends on your personal circumstances and may change in the future.

2-Year Fixed Term Account (Issue 3)

Balance: £1,000 – £200,000

Gross Annual Interest: 4.10%

AER*: 4.10%

- Interest is calculated daily and paid annually.

- You can choose to have interest paid into your Savings Account or Nominated Bank Account.

No, the interest rate is fixed and will not change during the fixed term.

At the end of the fixed term, if you do not provide us with instructions to open a new account for you, we will return your funds, and the interest earned, to your Nominated Bank Account. We will notify you before the end of the fixed term to let you know what your options are. If we are unable to send the funds to your nominated account we will hold your funds in an interest bearing easy access account until we receive instructions from you.

This projection is just an example and does not consider your personal circumstances.

It assumes that:

- Interest is paid into the account.

- No further deposits or withdrawals are made.

- The period does not include a leap year.

Deposit at account opening: £1,000

Interest earned at the end of the term (24-months): £83.68

Balance at 12 months with interest: £1,043.10

Balance at the end of the term with interest (24-months): £1,083.68

To open this account, you must:

- Be 18 years or over.

- The account can only be used for individuals.

- Be a UK resident (for tax purposes).

- Have a valid mobile phone number.

- Have a valid email address.

Opening an account:

- You can apply for an account via our mobile app which can be found here.

- You will need your contact details, email address and details of your UK current account you wish to register as your Nominated Bank Account.

- If we need additional information about your application, we will contact you.

Managing your account:

- You can manage your account via our app.

- You can also contact us by telephone to provide instructions about your account.

Minimum / Maximum balance:

- Minimum balance – £1,000.

- The maximum balance is £200,000 per account holder. If you deposit more than this, the extra amount will be returned to your nominated bank account. This limit applies to the total balance across all your Afin Bank deposit accounts.

- Your eligible deposits with Afin Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered.

- You cannot make withdrawals during the fixed term. We will write to you before the end of your fixed term to give you information on what to do next.

- In exceptional cases, we may allow a withdrawal at our discretion. You will need to provide evidence, but we are not required to approve it. If we do approve the withdrawal, we will return the funds, and any interest earned to your nominated bank account.

- An account may only be held in single names.

- If you do not meet the minimum balance within 14 days of opening your account, we will cancel your account without penalty or notice and return your funds to your Nominated Bank Account.

- You cannot access the funds in your account before the end of the term once the funds meet the minimum balance requirements, your account will be activated from that date.

- You can fund your account multiple times within the deposit window (first 14 days from account opening), subject to the deposit limits.

- If you wish to change your Nominated Bank Account, you can do so in the app.

Your Nominated Bank Account:

- Your Nominated Bank Account is where we will send your money based on your maturity instructions.

- Your Nominated Bank Account must be a UK current account in your name.

Interest rate definitions:

- AER stands for Annual Equivalent Rate. It shows what the interest rate would be if interest were paid and compounded once each year.

- Interest is only compounded if you choose to pay the annual interest earnings into this account and not your Nominated Bank Account.

- Gross p.a. is the interest rate without tax deducted.

Tax:

- Interest is paid gross, without the deduction of income tax. It is your responsibility to ensure that any tax is paid. The interest earned on this account becomes taxable in the tax year the bond matures.

- We reserve the right to make a deduction for withholding tax as may be required by law from time to time.

- The tax treatment of the interest payable depends on your personal circumstances and may change in the future.

5-Year Fixed Term Account (Issue 4)

Balance: £1,000 – £200,000

Gross Annual Interest: 3.80%

AER*: 3.80%

- Interest is calculated daily and paid annually.

- You can choose to have interest paid into your Savings Account or Nominated Bank Account.

No, the interest rate is fixed and will not change during the fixed term.

At the end of the fixed term, if you do not provide us with instructions to open a new account for you, we will return your funds, and the interest earned, to your Nominated Bank Account. We will notify you before the end of the fixed term to let you know what your options are. If we are unable to send the funds to your nominated account we will hold your funds in an interest bearing easy access account until we receive instructions from you.

This projection is just an example and does not consider your personal circumstances.

It assumes that:

- Interest is paid into the account.

- No further deposits or withdrawals are made.

Deposit at account opening: £1,000

Interest earned at the end of the term (60 months): £205.00

Balance at 12 months with interest: £1,038.00

Balance at the end of the term with interest (60 months): £1,205.00

To open this account, you must:

- Be 18 years or over.

- The account can only be used for individuals.

- Be a UK resident (for tax purposes).

- Have a valid mobile phone number.

- Have a valid email address.

Opening an account:

- You can apply for an account via our mobile app which can be found here.

- You will need your contact details, email address and details of your UK current account you wish to register as your Nominated Bank Account.

- If we need additional information about your application, we will contact you.

Managing your account:

- You can manage your account via our app.

- You can also contact us by telephone to provide instructions about your account.

Minimum / Maximum balance:

- Minimum balance – £1,000.

- The maximum balance is £200,000 per account holder. If you deposit more than this, the extra amount will be returned to your nominated bank account. This limit applies to the total balance across all your Afin Bank deposit accounts.

- Your eligible deposits with Afin Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered.

- You cannot make withdrawals during the fixed term. We will write to you before the end of your fixed term to give you information on what to do next.

- In exceptional cases, we may allow a withdrawal at our discretion. You will need to provide evidence, but we are not required to approve it. If we do approve the withdrawal, we will return the funds, and any interest earned to your nominated bank account.

- An account may only be held in single names.

- If you do not meet the minimum balance within 14 days of opening your account, we will cancel your account without penalty or notice and return your funds to your Nominated Bank Account.

- You cannot access the funds in your account before the end of the term once the funds meet the minimum balance requirements, your account will be activated from that date.

- You can fund your account multiple times within the deposit window (first 14 days from account opening), subject to the deposit limits.

- If you wish to change your Nominated Bank Account, you can do so in the app.

Your Nominated Bank Account:

- Your Nominated Bank Account is where we will send your money based on your maturity instructions.

- Your Nominated Bank Account must be a UK current account in your name.

Interest rate definitions:

- AER stands for Annual Equivalent Rate. It shows what the interest rate would be if interest were paid and compounded once each year.

- Interest is only compounded if you choose to pay the annual interest earnings into this account and not your Nominated Bank Account.

- Gross p.a. is the interest rate without tax deducted.

Tax:

- Interest is paid gross, without the deduction of income tax. It is your responsibility to ensure that any tax is paid. The interest earned on this account becomes taxable in the tax year the bond matures.

- We reserve the right to make a deduction for withholding tax as may be required by law from time to time.

- The tax treatment of the interest payable depends on your personal circumstances and may change in the future.

Applying for

a Fixed Term

Savings Account

To apply for a savings account with us, you simply need to download our app, available on iOS and Android.

Once you’ve opened an account, choose the savings account that works best for for your needs.

Deposit your funds and start saving. Your journey starts here!

Why choose a Fixed Term Savings Account?

Whatever your savings goals may be, our Fixed Term Savings Accounts can help you get to your goals without complication. Here’s why we could be the right fit for you:

A fixed interest rate for the entire term, which can offer peace of mind no matter how the market fluctuates

A choice between one-year or two-year terms to match your savings goals

You do not need immediate or regular access to your savings

An app to easily manage your account and see your growth

FSCS protection

Your eligible deposits with Afin Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered.

Interest rates are fixed for the entire term, meaning withdrawals are not allowed, unless in exceptional circumstances. If you’re looking for

an account where you want to regularly add to your savings and don’t require instant access, savings accounts like our

Notice Saver Savings Account might be a better fit for you.

How do Fixed

Term Savings Accounts work?

FAQs

Show all FAQs-

A fixed-term savers account is a type of savings account where you deposit money for a specific period, ranging from a few months to several years.

Key Features

- Set Period: Your funds are locked in for the agreed term, ensuring stability for your savings.

- Guaranteed Interest Rate: Enjoy a fixed interest rate for the duration of the term, which is often higher than regular savings accounts.

This type of account is ideal if you want a secure way to grow your savings and don’t need immediate access to your funds.

-

Why Choose a Fixed-Term Savers?

Fixed-term Saver accounts are ideal if you:

- Like certainty: A fixed interest rate means you know exactly what you’ll earn.

- Can save without access: Perfect if you don’t need to withdraw your money for a set time.

-

You have 14 days to fund your fixed term saver account after opening it. The maximum you can put in your savings is £200,000. After 14 Days: We won’t be able to accept more deposits. Any funds over £200,000 or received after the 14-day funding window will be returned to your Nominated Account.

Once you’ve made the initial deposit during your 14-day funding window into a fixed-term deposit account, you cannot add more funds during the term.

-

No, the interest rate on a fixed-term Saver account does not change once you’ve locked in your deposit.

- The rate is guaranteed for the entire duration of the term.

- This means that even if market interest rates fluctuate, your rate remains fixed, giving you a stable and predictable return on your savings.

This feature makes fixed term saver an excellent choice for those seeking certainty and reliability in their financial planning.

-

The number of days remaining in your fixed term is always visible in the app.

Towards the end your fixed term we will also send you the following notifications:

- First Notification: We’ll contact you at least 21 days before your account matures.

- Reminder: A friendly reminder will arrive about 14 days before the maturity date to keep you informed.

*AER, or Annual Equivalent Rate, shows what the interest rate would be if interest was paid and compounded once each year.