It has been brought to our attention that a scam company (NestEgg Savings) is encouraging customers to open Afin accounts on their website(s). This is a scam. Afin Bank is not affiliated with NestEgg Savings or any third-party websites offering our product.

For your safety, only open an Afin account through the official Afin app. For more information on online scams and how to report them, please visit the FCA website.

If you have sent money to NestEgg Savings, please contact us directly on 0333 344 2974.

Saving your money can be

hard at the best of times. So

here at Afin, we’ve made it

simple.

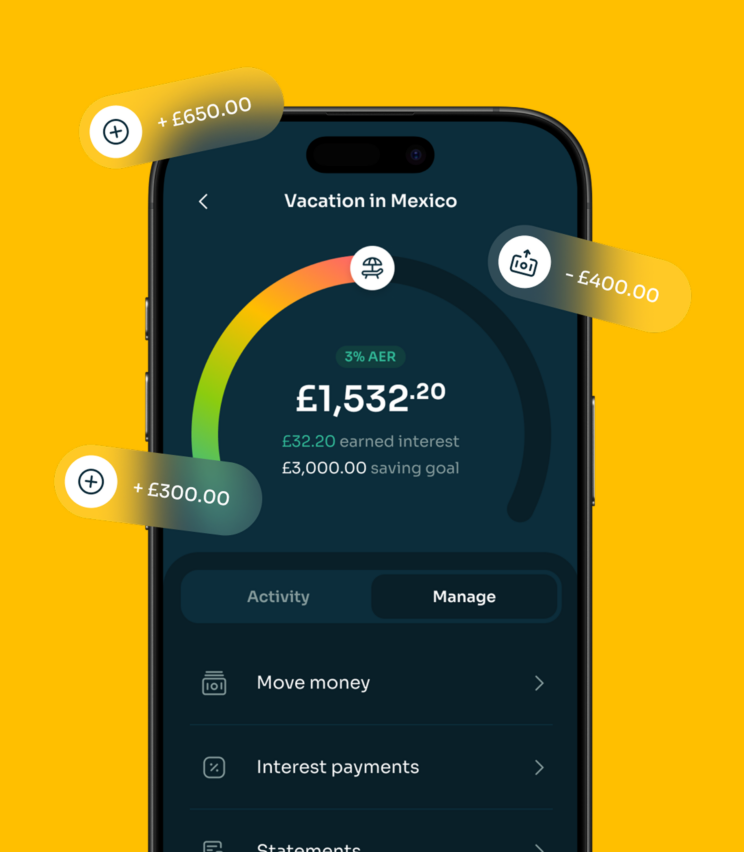

If you’re saving towards your future, our savings accounts are designed to help you grow your savings as easily as possible. And to make it as simple as possible, it’s all manageable using our easy-to-use app.

Ready to open a Savings Account in the UK? We’re here to help.

Our savings accounts

Picking the right savings account for you is simple at Afin. Here’s a quick comparison to help you weigh up your options:

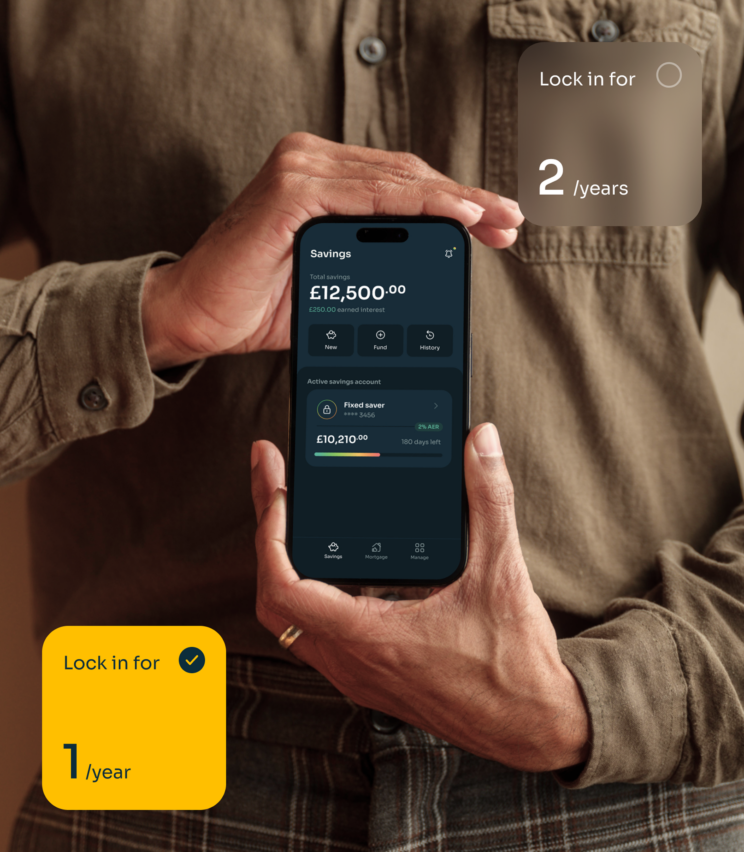

Fixed Term

When looking for high-interest savings accounts in the UK, choose our Fixed Term Saver option if you’re planning to lock your money away for a guaranteed return.

- Lock in your savings for a fixed term and a get secure return

- A choice of two term lengths, to suit your goals

- A great option for saving over the medium-term

- You do not need immediate or regular access to your savings

Notice Saver – coming soon

When you want more flexibility and access to your savings, choosing a Notice Saver Account could also be the best option for you while building interest.

- Withdraw funds with notice while keeping a higher rate

- A Notice Saver is good for saving in the short to medium-term

- You can earn healthy returns while staying in control

- You do not need instant access to your savings

Applying for

a savings account

To apply for a savings account with us, you simply need to download our app, available on iOS and Android.

Once you’ve opened an account, choose the savings account that works best for for your needs.

Deposit your funds and start saving. Your journey starts here!

Why save with us?

Our savings accounts are designed to suit your savings needs and to help meet your goals. Here’s why opening an Afin savings account might suit you:

Competitive rates

When you bank with us, we offer competitive rates on your savings with our Fixed Term Saver and Notice Saver Account options, depending on your saving goals.

Simple and secure

Our user-friendly mobile app, with comprehensive security features, makes opening a savings account and managing your savings as secure as possible.

FSCS protection

Your eligible deposits with Afin Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered.

FAQs

Show all FAQs-

Opening an account is simple and can be done through our mobile app.

Here’s what you’ll need to get started:

- Your contact details

- Your email address

- Valid Identification document and proof of address – see question What account opening checks do you carry out?

- Details of your UK current account that you’d like to register as your Nominated Bank Account.

Please note that applications are only accepted through our mobile app and can’t be processed over the phone or via post.

If you need any help along the way, our Customer Service Team is here to guide you. Don’t hesitate to reach out – we’re here to make your experience seamless and stress-free.

-

To open a savings account with Afin, you will need to:

- Be 18 years or older.

- Open the account for your personal use (we currently don’t support accounts for clubs, charities, or accounts held in trust).

- Be a UK resident for tax purposes.

- Provide a valid identification document and proof of address – see question What account opening checks do you carry out?

- Have a valid mobile phone number and email address so we can stay connected with you.

- Already have a UK current account in your name to be your nominated account which you can use to transfer money to and from your Afin savings account.

-

To ensure your account is set up smoothly and securely, you’ll need to provide some identification. Don’t worry—it’s a simple process.

Valid ID Documents

To verify your identity, please provide one of the following:

- Passport

- EU identity card

- Biometric residence permit

- UK driving licence (full or provisional)

Proof of Address

We will need to confirm your address and a document to verify this. You can use any of the following, if they are valid and recent:

- Full or provisional UK driving licence (if not already used as your ID)

- Bank, credit card, or mortgage statement (less than 3 months old)

- Utility bill (less than 3 months old)

- Council Tax bill (issued within the last 12 months)

- UK Government letter, such as a benefits confirmation, poll card, or tax code notice. (issued within the last 12 months)

A Quick Tip

To make the process seamless, ensure the name on your proof of address matches the name on your ID document. We’re unable to accept documents with shortened or mismatched names.

-

At Afin Bank, we’re here to provide clear, fair and accessible support. If you have any questions about applying for an account or require additional support, we offer several ways to get in touch:

How to Get in Touch

Email Us at: support@afinbank.com.

Call Us: Speak with our friendly team at 0333 344 2974. We’re available Monday to Friday, 9 am to 5 pm (except bank holidays).

Accessible Formats: Need information in braille, large print, audio, or another format? Email us at support@afinbank.com, and we’ll provide what you need.

At Afin Bank, we believe everyone deserves helpful and accessible support. If you need anything, please get in touch. We’re always happy to assist.

-

Funding your Afin account is quick and easy. You can make a deposit whilst you are opening an account following the prompts or after.

If you wish to fund your account after, just follow these simple steps to pick the easiest way for you.

- Open the app and select the account you’d like to fund, click “manage”.

- Once you have clicked “manage” tap “fund account”.

- You can then choose to make a deposit through Open Banking or through a Bank Transfer.

For Open Banking:

- Choose Open Banking as your payment method.

- Pick your bank from the list and follow the prompts. You’ll be redirected to your banking app or website to approve the transfer.

For a Bank Transfer

- Choose Bank Transfer. You’ll see your unique sort code and account number displayed in the app.

- From your nominated bank account, make a payment using these details.

A couple of things to note:

- Each account opened will have its own unique account number.

- For Payee Name, you will need to enter your own name.

- Some banks may show the sort code as ClearBank (our clearing bank) – this is correct.

- If you see “No Match” or “Unavailable,” double-check the details. If everything looks right but it still won’t match, your bank will be able to help.